Depreciation estimate calculator

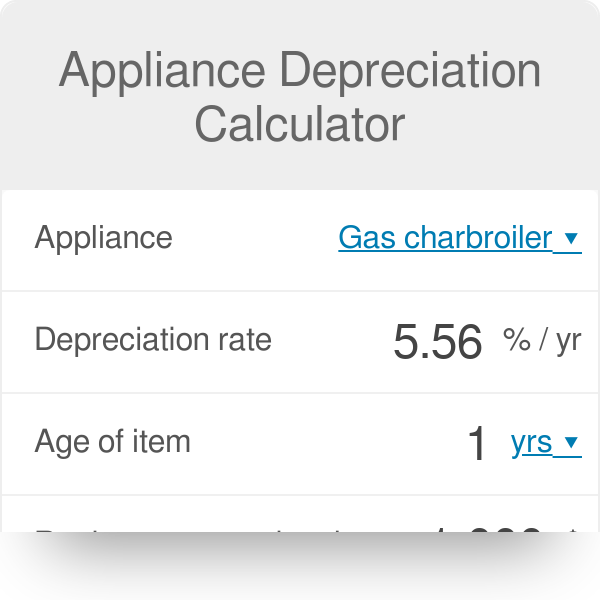

Determine the cost of the asset. You can browse through general categories of items or begin with a keyword search.

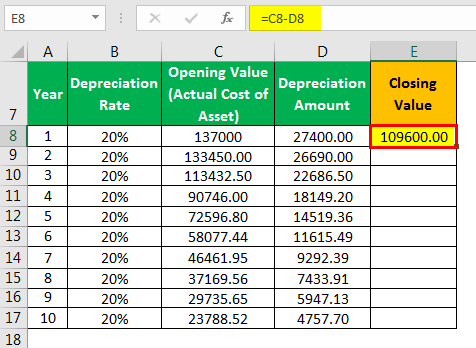

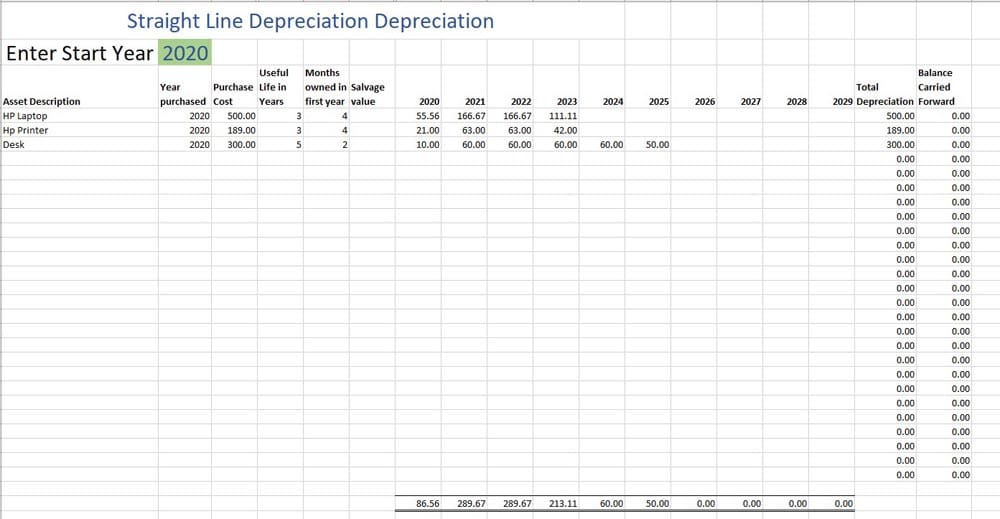

Depreciation Schedule Formula And Calculator Excel Template

Input the current age of the vehicle - if the car is new simply input 0.

. Calculate depreciation and create depreciation schedules. Enter the number of years you will own the car. Use this depreciation calculator to forecast the value loss for a new or used car.

Includes online calculators for activity declining balance double declining balance straight line sum of years digits units of production real estate property and variable declining balance depreciation. It provides a couple different methods of depreciation. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods.

Its accuracy and applicability to your circumstances is not guaranteed. With this method depreciation is calculated equally each year during the useful life of the asset. See the results for Fixed asset depreciation calculator in Agawam.

The straight line calculation as the name suggests is a straight line drop in asset value. Ad Updated every 3 minutes. These are set at 1 base currency unit.

Select your Base Currency that you want to quote against. The depreciation of an asset is spread evenly across the life. By entering a few details such as price vehicle age and usage and time of your ownership we use our depreciation models to estimate the future value of the car.

There are many variables which can affect an items life expectancy that should be taken into consideration. Select the currency from the drop-down list optional Enter the purchase price of the vehicle. Enter your starting quote exchange rate 1.

See new and used pricing analysis and find out the best model years to buy for resale value. It is fairly simple to use. Dn Rate helps to minutely calculate the exact depreciation that will be charged on an asset in a year.

The calculator also estimates the first year and the total vehicle depreciation. The straight-line depreciation method is the easiest to calculate and the annual depreciation amount original net value of assets-estimated residual value service life. The calculator will calculate the depreciation estimate based on a series of data points from our comprehensive database and compare this with similar properties to give you an approximate depreciation value for your investment property.

The basic way to calculate depreciation is to take the cost of the asset minus any salvage value over its useful life. Simply plug in your address to see your value and sales. All you need to do is.

Select your Quote Currency. Our estimates are based on the first three years depreciation forecast. Determine the useful life of the asset.

Last year depreciation 12 - M 12 Cost - Salvage Life And a life for example of 7 years will be depreciated across 8 years. Discover the Best Strategies to Market a Property and Save Money on Financing. This depreciation calculator is for calculating the depreciation schedule of an asset.

After five years the value of that new car is likely to drop by 60. Use this calculator to calculate an accelerated depreciation of an asset for a specified period. We will even custom tailor the results based upon just a few of your.

Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. The calculator should be used as a general guide only. AFTER FIVE YEARS.

Ad Receive Pricing Updates Shopping Tips More. The original price of the machinery is 5000 the estimated useful life is 10 years the estimated residual value is 500 and the depreciation is calculated. Dn rate of different assets is different.

This calculator will calculate the percentage change of the Quote Currency relative to the Base Currency and the. Use this calculator for example for depreciation rates entered as 15 for 150 175 for 175 2 for 200 3 for 300. This new car will lose between 15 and 25 every year after the steep first-year dip.

Use this calculator specifically to calculate depreciation of residential rental or nonresidential real property related to IRS form 4562 lines 19 and 20. The calculator allows you to use Straight Line Method Declining Balance Method Sum of the Years Digits Method and Reducing Balance Method to calculate depreciation expense. The second method is the declining.

Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. First one can choose the straight line method of depreciation. You probably know that the value of a vehicle drops dramatically just after you buy it and it depreciates with each year.

A depreciation factor of 200 of straight line depreciation or 2 is most commonly called the Double Declining Balance Method. The IRS also allows calculation of depreciation through table. Calculate car depreciation by make or model.

Depreciation formulas and Excel equivalent functions. Depreciation is a method for spreading out deductions for a long-term business asset over several years. This calculator is for illustrative and educational purposes only.

Timespan New car value. The Depreciation Calculator computes the value of an item based its age and replacement value. You may wish to consult your own adviser.

Depreciation is handled differently for accounting and tax purposes but the basic calculation is the same. It will then depreciate another 15 to 25 each year until it reaches the five years mark. You can use this calculator to either find out how much your car is worth or check whether the price.

This car depreciation calculator is a handy tool that will help you estimate the value of your car once its been used. Enter your ending quote exchange rate 2. So it helps the accounting software to exactly calculate the yearly depreciation of different assets as.

This calculator calculates depreciation by a formula. Use our car depreciation calculator to estimate how much your vehicle could decrease in value each year over the next six years. Divide the sum of step 2 by the number arrived at in step 3 to get.

It assumes MM mid month convention and SL straight-line depreciation. The straight line calculation steps are. How to Calculate Straight Line Depreciation.

Depreciation Calculator Property Car Nerd Counter

Depreciation Formula Calculate Depreciation Expense

Macrs Depreciation Calculator With Formula Nerd Counter

Free Depreciation Calculator In Excel Zervant

Depreciation Formula Calculate Depreciation Expense

Car Calculator Depreciation By Putu Angga Risky Raharja

Depreciation Formula Calculate Depreciation Expense

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation Calculator Depreciation Of An Asset Car Property

Depreciation Calculation

Depreciation Formula Calculate Depreciation Expense

Appliance Depreciation Calculator

Free Depreciation Calculator Online 2 Free Calculations

Depreciation Schedule Formula And Calculator Excel Template

Macrs Depreciation Calculator With Formula Nerd Counter

Free Depreciation Calculator Online 2 Free Calculations

Depreciation Calculator Property Car Nerd Counter